fsa health care contribution

Employees can put an extra 200 into their health care flexible spending accounts health FSAs next year the IRS announced on Oct. Check Out Our Offers.

Get The Benefits Of BASIC Technology For Your Company.

. Ad Exceptional Administration Support For Employers. Ask About BASIC Services Today. Both FSAs were designed to help employees set aside.

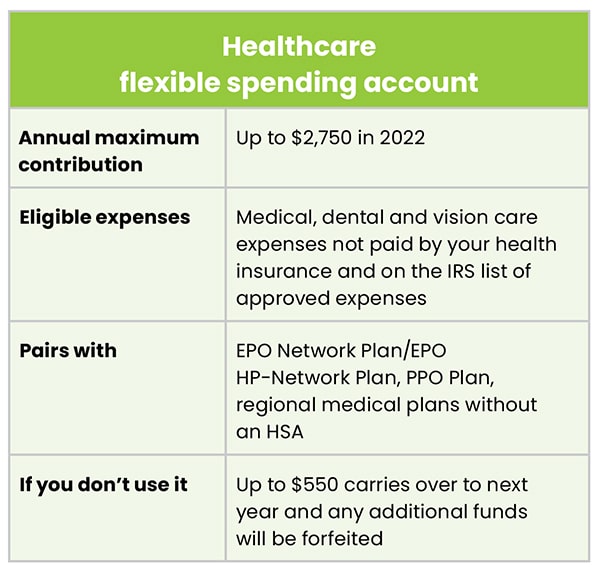

Easy implementation and comprehensive employee education available 247. As a result the IRS has revised contribution limits for 2022. The limit for 2022 contributions is 2850 up from 2750 in 2021.

Always keep the latest FSA contribution limits in mind in 2022 you can contribute up to 2850. The IRS has not yet. In 2023 employees can put away as much as 3050 in an FSA an increase of about 7 from the current tax years cap of 2850.

Together we look forward to serving our combined employer clients through our HSA. An FSA isnt a savings account. Walk-in care options nationwide.

The health care Flexible Spending Amounts changed from 2850 to 3050 in maximum salary deferral contribution compared to last year. Over 1 million doctors pharmacies and clinic locations. Employees in 2023 can contribute up to 3050 to their health care flexible spending accounts FSAs pretax through payroll deductiona 200 increase from 2022the.

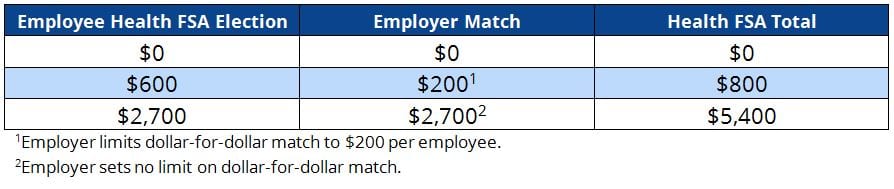

The maximum contribution for a Dependent Care FSA is 5000. There are a few things to remember when it. Second your employers contributions wont count toward your annual FSA contribution limits.

If you both have a Health Savings Account through your respective health plans the maximum you can contribute to your HSAs combined is the family contribution limit. In the maximum carryover. This is a 200 increase from.

Elevate your health benefits. Ad 247 virtual care. Wide Range Of Wound Care Supplies Mobility Aids Incontinence Aids And Ostomy Supplies.

There are two different types of FSAs. Thus 2850 is the limit each employee may make per plan year regardless of the number of other individuals spouse. This also applies if your spouse has a Medical FSA even if you are not covering your spouse on.

1000 Brands All In One Place. Basic Healthcare FSA Rules. Ad Custom benefits solutions for your business needs.

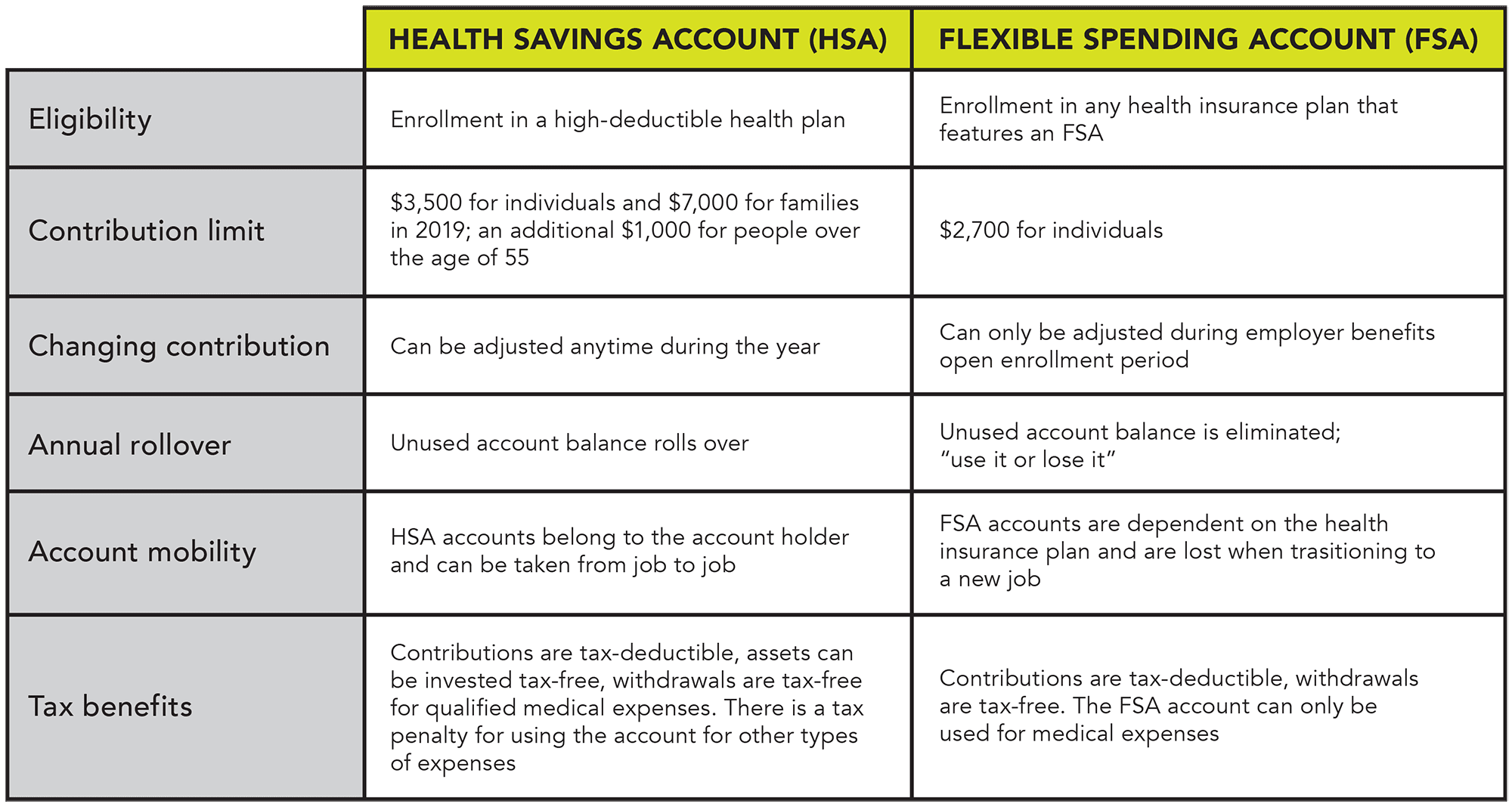

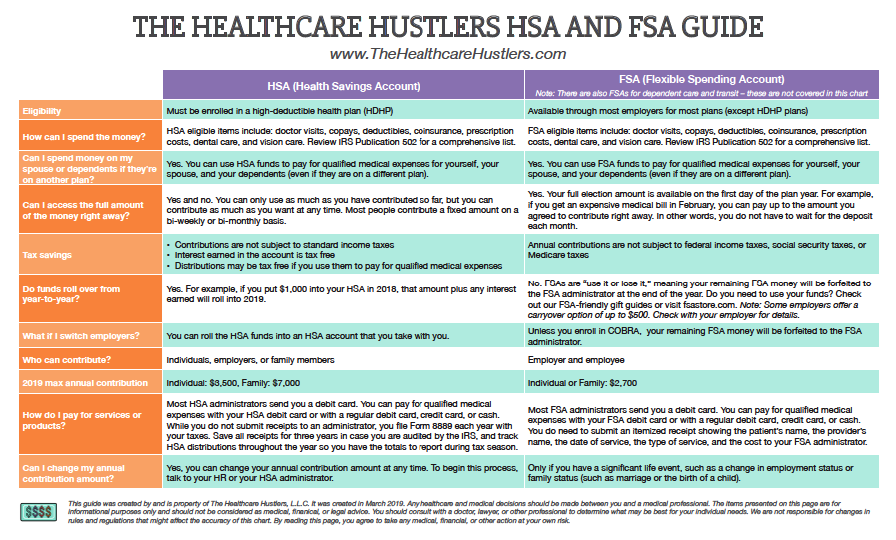

Your employer FSA or financial institution HSA decides their minimum contributions for example 100. You or your spouse cannot have a health care Flexible Spending Account FSA or Health Reimbursement Account HRA in the same year. The federal government decides HSA maximum amounts.

Ad Healthcare Healthy Living Store. Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. 24-hour nurse help line and a team of medical experts.

HealthEquity and WageWorks have joined together to help working families connect health and wealth. A Medical Flexible Spending Arrangement FSA or Health Reimbursement Arrangement HRA. Meanwhile single workers who want to.

18 as the annual contribution limit rises to. The contribution limit applies on an employee-by-employee basis. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

Carry over up to 61000 from one plan year to the next when you re-enroll in a Health Care FSA - theres virtually no risk of losing your hard-earned money How You Save. FSA limits were established with the enactment of the Affordable Care Act and are set to be indexed for inflation each year. For plan years beginning in 2023 the ACAs adjusted dollar limit on employees salary reduction contributions to health FSAs increases to 3050.

The 2021 plan year maximum contribution for a General Purpose or the Limited Purpose Health Care FSA is 2750 per year. One for health and medical expenses and one for dependent carechildcare expenses. TexFlex health care flexible spending accounts FSA TexFlex limited-purpose flexible spending account FSA - for Consumer Directed HealthSelect participants only.

Get a free demo. Any unused money in your account goes back to your employer if you leave your job. With a Health Care.

The 2022 dependent care FSA contribution limit will remain at 5000 for single taxpayers and married couples filing jointly or 2500 for married couples filing separately. For example if you earn 45000 per year and allocate 2500 to your FSA for health care. This is a catch-up contribution to help.

10 as the annual contribution limit rises to. The Internal Revenue Service IRS has announced 2023 Flexible Spending Account FSA contribution limits which increase the amount you may contribute to a Health. Health FSAs let workers stash away pretax money for qualifying medical expenses.

FSAs also have use it or lose it rules. You may forfeit the.

2021 Fsa Contribution Cap Stays At 2 750 Other Limits Tick Up

Can Employers Add To Employee Health Fsa Contribution Core Documents

Infographic Hsa Vs Fsa A Visual Guide For Employees Lively

Flexible Spending Account Contribution Limits For 2022 Goodrx

What Is A Flexible Spending Account Clydebank Media

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Understanding The Year End Spending Rules For Your Health Account

Flexible Spending Account Fsa Surency General

Using Bestflex Fsa Employee Benefits Corporation Third Party Benefits Administrator

Hsa Vs Fsa What Is The Difference Between Them Aetna

What Is An Fsa Card Creditrepair Com

Hsa Vs Health Care Fsa Which Is Better For You And Your Employees Insperity

Healthcare Flexible Spending Account My Aci Benefits

New Hsa Limits For 2022 And Determine If Fsa Or Hsa Is Right For You Alltrust Insurance

Can I Change The Amount I Contribute To My Fsa Mid Year

Open An Hsa Or Fsa Healthcare Savings Visa

Health Care Fsa Contribution Limits Change For 2022

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health