franklin county ohio tax deed sales

If the property is not. Tax Lien and Tax Deed.

Franklin County Treasurer Foreclosure

The Delinquent Tax Division holds an annual tax lien sale to collect outstanding delinquent taxes.

. If you should have any further questions please contact our office at 509 545-3518 or email us at treasurercofranklinwaus. The sale vests in the purchaser all right title and. Get information on a Franklin County property and view your tax bill.

Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. The following is a list of the services and duties of the Delinquent Tax Division at the Franklin County Treasurers Office. Public Property Records provide information on homes land or commercial properties including titles mortgages property.

Franklin County Property Records are real estate documents that contain information related to real property in Franklin County Ohio. Ad Find Foreclosed Properties at Huge 50 Savings. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the entire delinquency.

572119 and Tax Lien Certificates see notes Sec. All eligible tax lien certificates are bundled together and sold as part of a single portfolio. Overview of the Sale.

The property is sold to the successful bidder state laws differ though often it is sold for the amount of unpaid taxes. The real estate tax collection begins with the assessment of the real estate parcels in Franklin County. Our office is open.

They can then fill out an application for re-sale of tax title property on particular parcels - Land Sale Application for the commissioners to authorize the re-sale of the tax title property. You own the right to collect the past due taxes plus interest. Both sales give you the chance to make big profits but the lien means you dont immediately own the property.

123 Main Parcel ID Ex. John Smith Street Address Ex. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible.

In an effort to recover lost tax revenue tax delinquent property located in Franklin Ohio is sold at the Warren County tax sale. New Monthly Real Estate Sales Dashboard. This office is selling the tax lien or the right to collect the delinquent taxesThe outstanding tax dollars are paid in full to the Franklin County Treasurer and the purchaser of the tax lien is owed the balance plus any additional fees and interest this is referred to as the redemption amount.

The Franklin County Treasurer holds the states first and best lien against real property located in Franklin County. Ask how to set up a payment plan to pay delinquent taxes. Access The Discounted Listing of Cheap Properties.

Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. In the First Floor Press RoomAuditorium of the Franklin County Courthouse 373 S. 18 per annum for tax lien certificates.

DELINQUENT TAX DEPARTMENT UPDATE. According to state law the sale of Ohio Tax Deeds are final and the winning bidder is conveyed. Successful bidders at the Warren County Ohio tax deed sale receive an Ohio tax deed.

The Tax Incentives Hub is a one-stop shop for information about current property tax incentives in Franklin County. Ohio is unique in that it offers both tax lien certificates and tax deeds. Register for 1 to See All Listings.

Ad Find Tax Foreclosures Under Market Value in Ohio. Tax Deeds are sold to the. 8252021 - Vaccine Requirement For Employees.

Generally the minimum bid at an Franklin County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property. Once again the Franklin County Recorders Office had a record-breaking year that mirrored the fervor of the Central Ohio housing market. High Street Columbus Ohio 43215 or online at http sfranklinsheriffsaleauctionohiogov.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Premium bid highest bid tax deeds. Click to read more.

Look for lien certificate auctions in Franklin County Columbus Cuyahoga County Cleveland and Hamilton County Cincinnati. Ad Free Course Reveals How To Find The Best Properties In Your Area. The County assumes no responsibility for errors in the information and does not guarantee that the.

Last week Franklin County Recorder. Our Sheriff Sales are held every Friday morning at 900 am. HIGH ST 17TH FLOOR COLUMBUS OH 43215-6306.

Sheriff Sales are not held on Federal Holidays. In 2021 our office recorded 234197 documents shattering our previous record set in 2020 of 209193. Ohio law requires counties to revalue all real property every six years with an update at the three year midpoint as ordered by the Tax Commissioner of the State of Ohio.

Columbus Ohio 43215 Get Directions. Interest Rate andor Penalty Rate. Tax Deed Sale Sec.

Find out about our annual tax lien sale and access information for taxpayers and potential buyers. After a lien is sold if all lien charges and interest are not fully paid after one year the tax lien holder has the right to foreclose on the property. Ohio property tax sales are tax deed auctions or tax lien auctions.

Properties are advertised for three consecutive weeks beginning five weeks prior to. For tax lien certificates investors can get yields as high as 18 per annum with a one year right of redemption. Search for a Property Search by.

In Ohio the County Tax Collector will sell Tax Deeds to winning bidders at the Franklin County Tax Deeds sale.

Animal Shelter Medina County Ohio

Franklin County Treasurer Delinquent Taxes

Auditor Marion County Ohio Joan M Kasotis Auditor

Franklin County Treasurer Home

Franklin County Treasurer Delinquent Taxes

Zoning Code Click Here Nimishillen Township Stark County Ohio

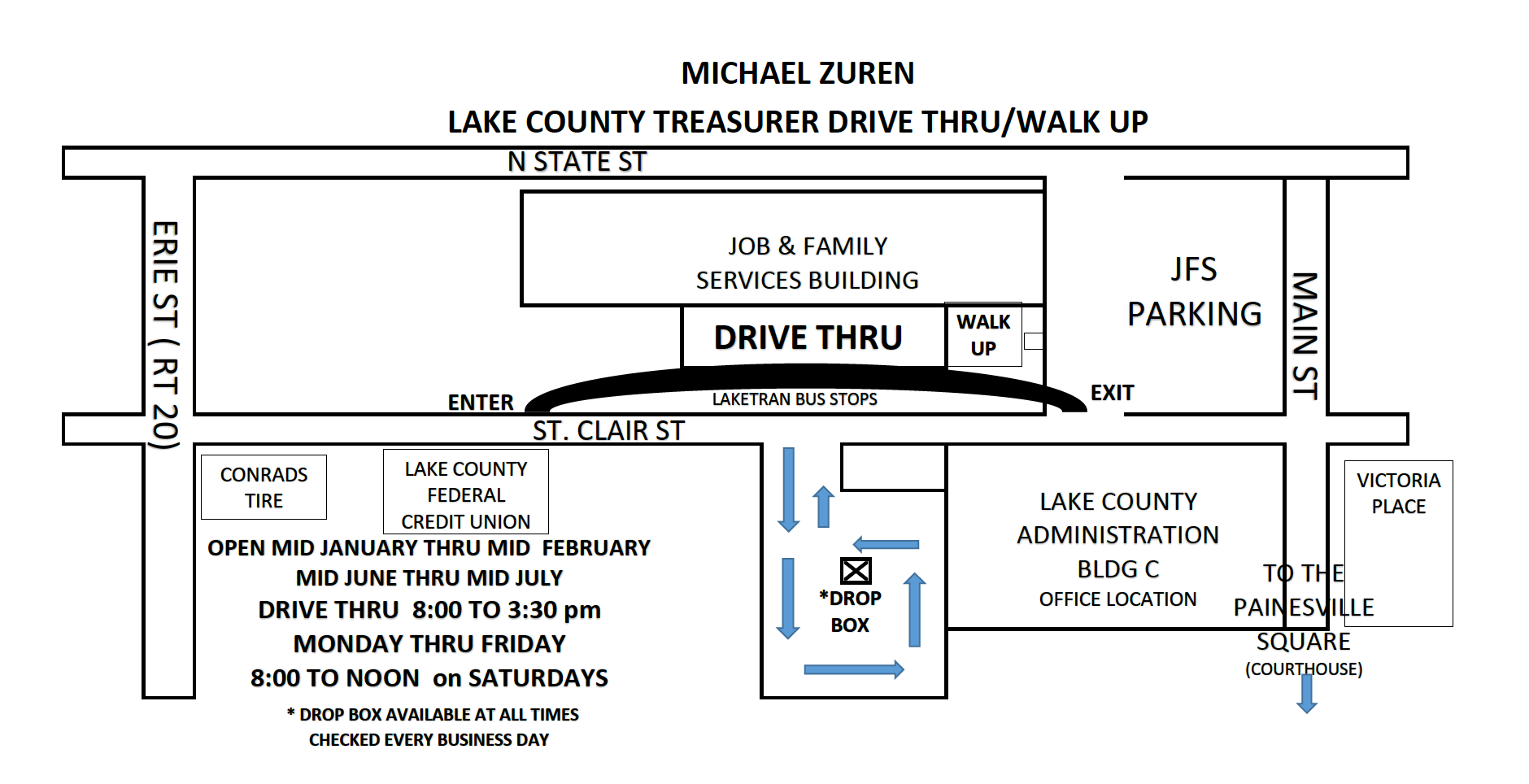

Property Tax Due Dates Treasurer

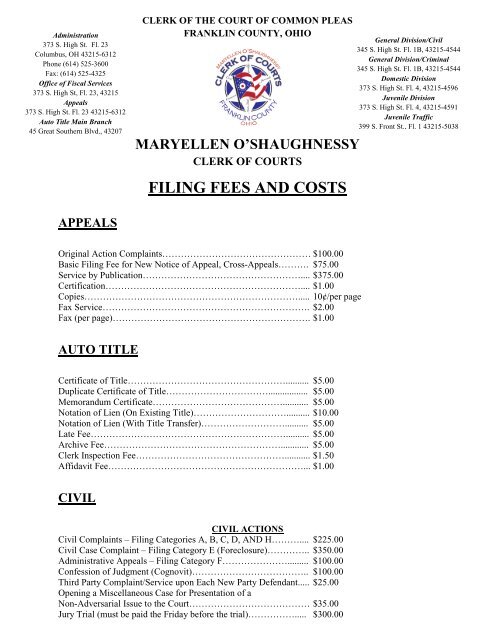

Filing Fees And Costs Appeals Franklin County Ohio

Auto Title Manual Franklin County Ohio

General Information County Auditor Website Morrow County Ohio

Advanced Search County Auditor Website Ross County Ohio

Historical Maps And Information Franklin County Engineer S Office

Franklin County Sheriff Real Estate Sales

Satisfying Tax Liens In Franklin County Ohio Tax Liens Libguides At Franklin County Law Library

Satisfying Tax Liens In Franklin County Ohio Tax Liens Libguides At Franklin County Law Library